ad valorem tax florida exemption

Florida property tax homestead exemption reduces the value of a home. This application is for use by nonprofit homes for the aged to apply for an ad valorem tax exemption for property as provided in section s 1961975 Florida Statutes FS.

Form Dr 418e Fillable Enterprise Zone Ad Valorem Property Tax Exemption Child Care Facility Application For Exemption Certification N 12 99

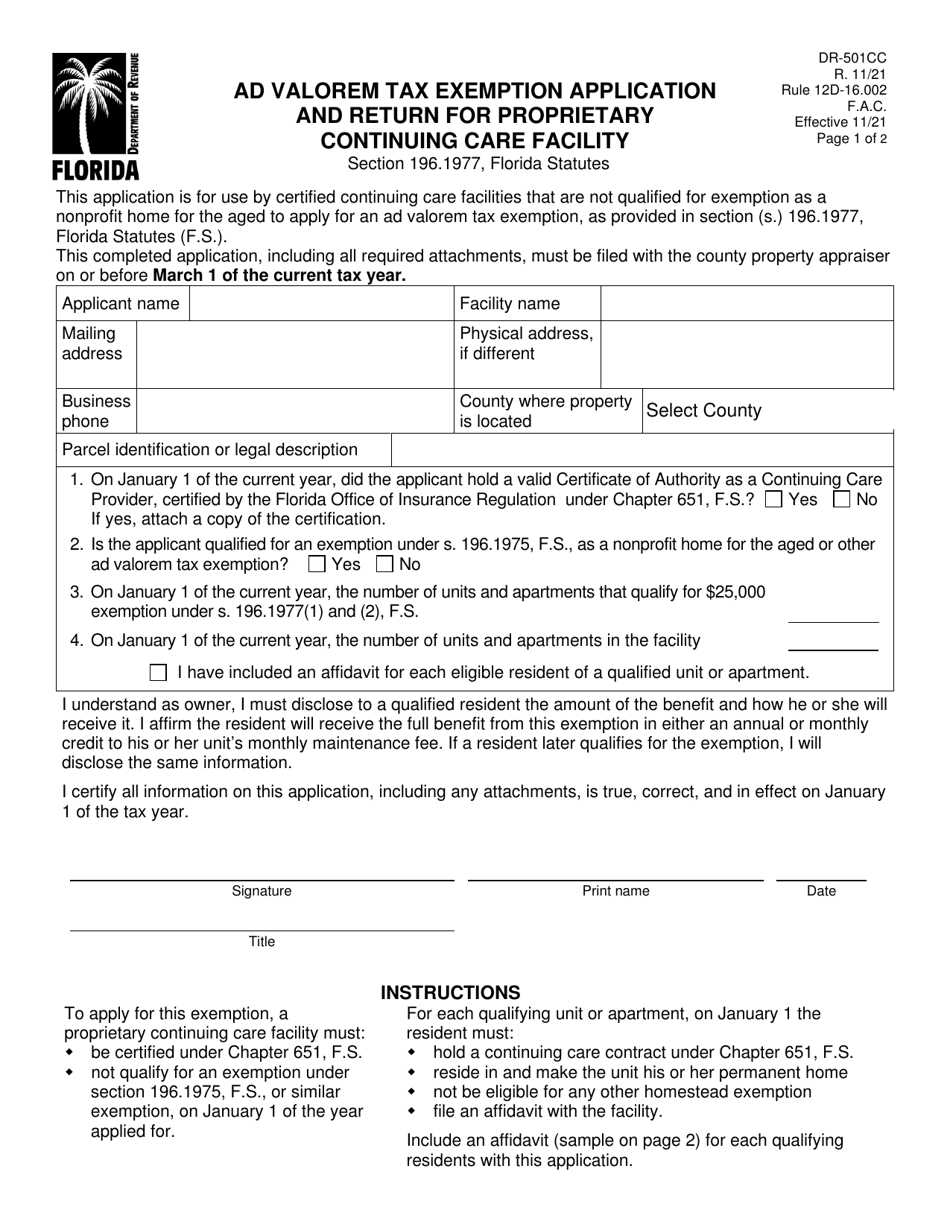

Florida Administrative Code Effective 1112 AD VALOREM TAX EXEMPTION APPLICATION PROPRIETARY CONTINUING CARE FACILITY Section 1961977 Florida Statutes File this form.

. Section 1961975 Florida Statutes. HOMES FOR THE AGED. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption.

HOMES FOR THE AGED. To be filed with the Board of County Commissioners the governing boards of. The Economic Development Office needs a tool such as the Ad Valorem Tax Exemption.

Section 1961975 Florida Statutes. The homestead exemption in Florida is a state law which means its the same no matter. On August 24 2010 pursuant to Article VII Section 3 of the Florida Constitution and Section 1961995 Florida Statutes the voters of Sarasota County approved a referendum authorizing.

INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION. Completed by each resident. AD VALOREM TAX EXEMPTION Application APPLICATION AND RETURN Sections 196195 196196 196197 1961978 196198 1962001 1962002 Florida Statutes This application is.

ECONOMIC DEVELOPMENT AD VALOREM PROPERTY TAX EXEMPTION. Of all the local taxes county or municipal governments are only authorized to offer relief ie tax exemptions for the following three taxes. AD VALOREM TAX EXEMPTION Application APPLICATION AND RETURN Sections 196195 196196 196197 1961978 196198 1962001 1962002 Florida Statutes This application is.

This would allow Cape Coral to compete with neighboring cities for companies. INDIVIDUAL AFFIDAVIT FOR AD VALOREM TAX EXEMPTION. On November 3 2020 City of Sarasota voters again passed a referendum that would extend the Economic Development Ad Valorem Tax Exemption EDAVTE program for ten years through.

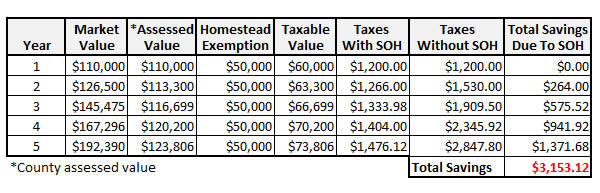

100001000 x 926 926. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year. Fabia vrs 4 bar map.

Florida Administrative Code. Veterans who are at least 10 disabled from wartime service or misfortune and who were honorably discharged are generally eligible for an. Further benefits are available to.

The State of Alabama offers tax breaks and related incentives for veterans including the following. Chapter 1961995 Florida Statutes. Name Spouses name Tax.

100000 x 10 10000. 29 2008 voters approved an amendment to the Florida Constitution raising this exemption to 50000. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real.

Authorized by Florida Statute 1961995. Section 1961978 Florida Statutes. AD VALOREM TAX EXEMPTION APPLICATION AND RETURN FOR MULTIFAMILY PROJECT AND.

From this amount the Homestead Exemption will be. 7 Economic Development Ad Valorem Tax. Ad Valorem Tax Exemption up to 160 acres of land and the.

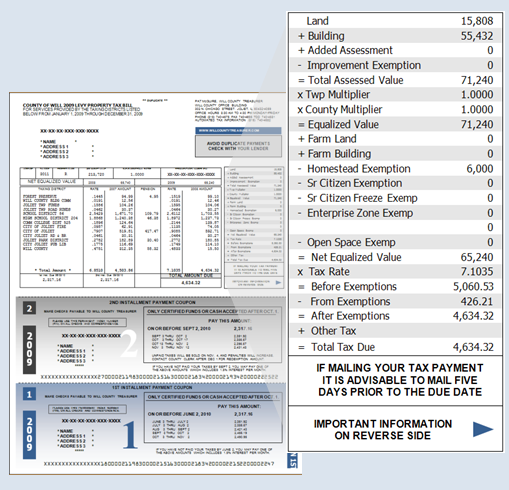

Exemption for Disabled Veterans. To this amount a Stormwater Fee is added. What is ad valorem tax exemption Florida.

AD VALOREM TAX EXEMPTION APPLICATION AND RETURN HOMES FOR THE AGED Section 1961975 Florida Statutes This form must be signed and returned on or before March 1. An ad valorem tax is a tax that is based on the assessed value of a property product. Ad valorem tax exemptions are available in Florida for projects i wholly owned by a nonprofit entity that is a corporation not-for-profit or its wholly owned subsidiary qualified as.

Florida Property Tax H R Block

Understanding Your Tax Bill Seminole County Tax Collector

Form Dr 501cc Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Proprietary Continuing Care Facility Florida Templateroller

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

Guide To The Homestead Tax Exemption For Central Florida Erica Diaz Team

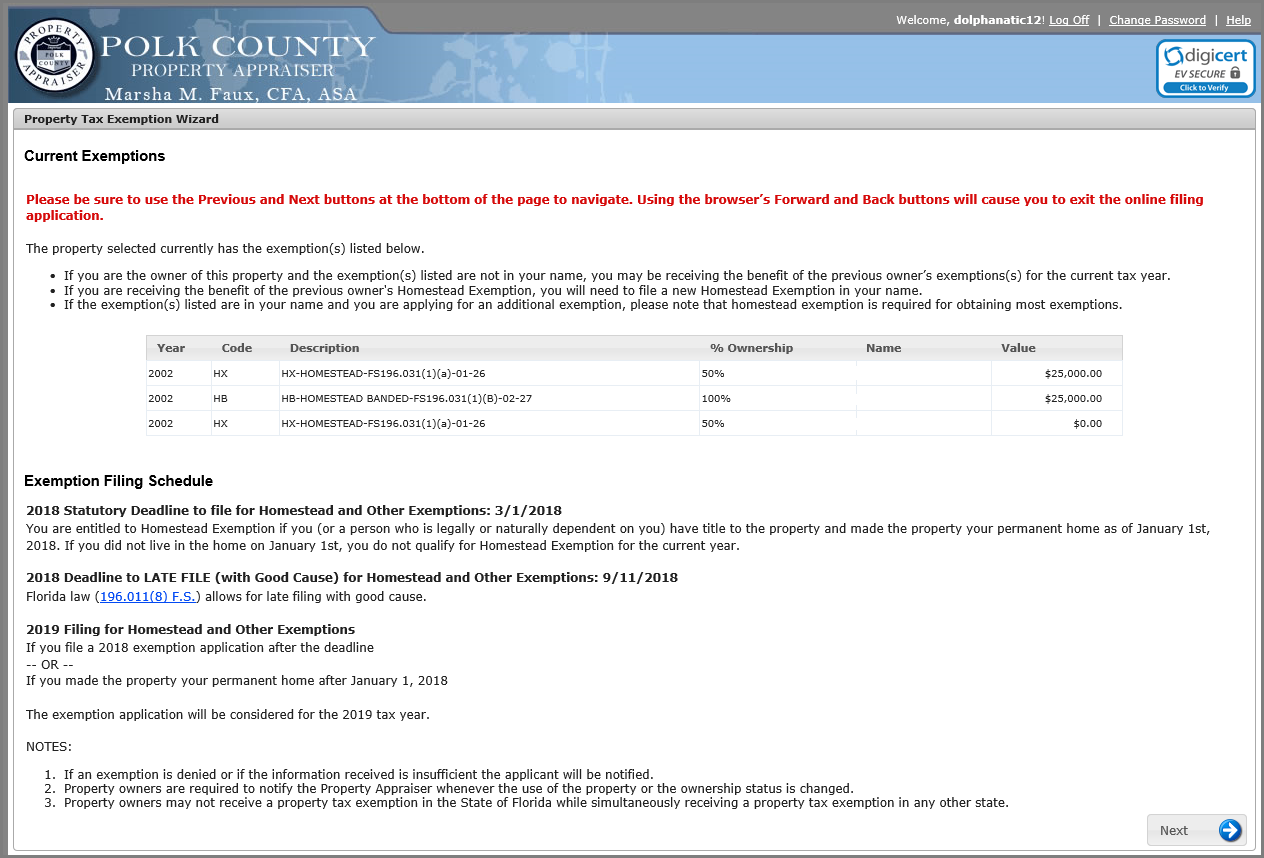

How Do I Register For Florida Homestead Tax Exemption

Ad Valorem Tax Reimbursement Form Fill Out And Sign Printable Pdf Template Signnow

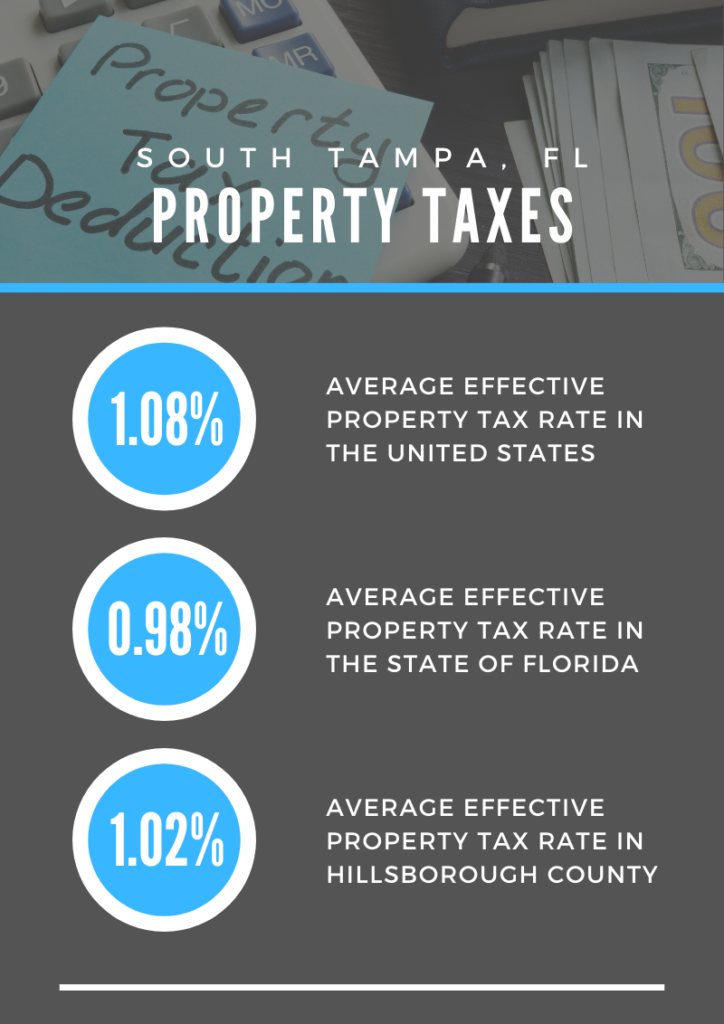

Property Taxes In South Tampa Fl Your South Tampa Home

Calendar Lauderdale By The Sea Fl Civicengage

How Do You Qualify For Florida S Homestead Exemption

Real Estate Property Tax Constitutional Tax Collector

Veteran Tax Exemptions By State

Homestead Exemption Attorney Miami Martindale Com

Solved In The State Of Florida For Example Homeowners May Chegg Com